Blog

How to Implement a Legal and Compliant Cash Discount Program.

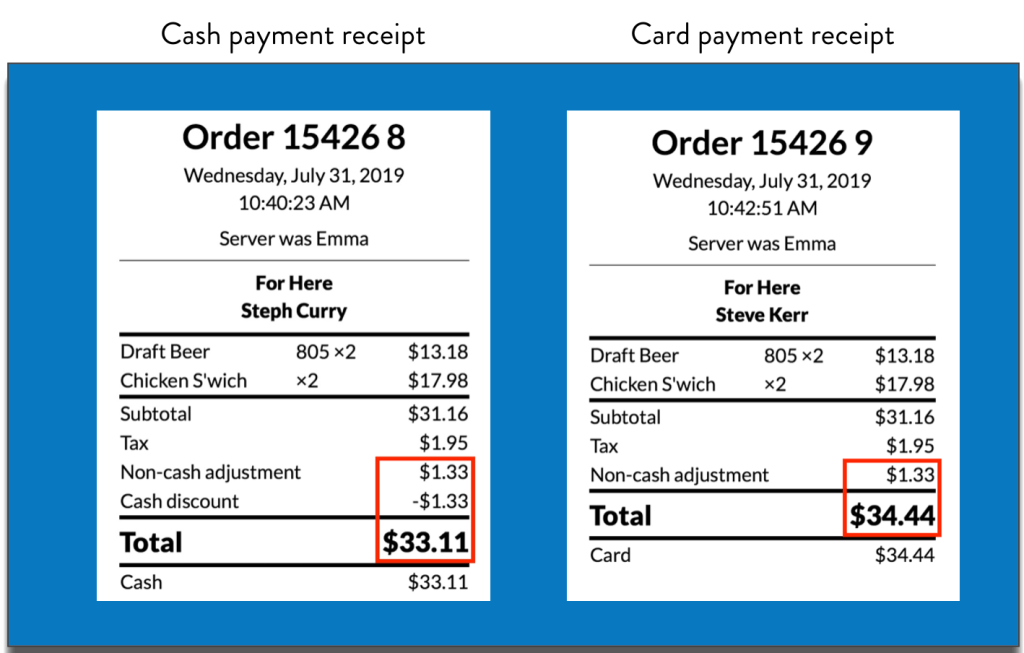

By now, you’ve probably become aware of the rising popularity of Cash Discount programs as a way to offset your merchant service fees. A Cash Discount program is a method of implementing a service fee to all customers who pay with a card, while providing a discount to those who pay with cash. Cash Discount…

Read More10 Things You Should Know About Opening a Merchant Bank Account.

If you’ve started to grow your business, or if you’re sick of paper invoices and snail mail to collect payments—you might be ready to open a merchant account to accept credit cards. Before you get started, it’s good to know what to expect when applying for a merchant account. You’re probably wondering… In this post,…

Read MorePayment Processing and Millennials : What You Need to Know.

Millennials (those approximately 21-37 years old in 2018) have been forcing businesses in every industry to rethink the way we engage and interact with our customers. Payment Processing and Millennials are largest segment of the population (83 million of them per the Census) in American History they have been a key catalyst for the monumental…

Read MorePoint of Sale Systems Explained: What is a POS System?

If you’re starting a business, you’re probably thinking about investing in a point of sale (POS) system. However, if you’ve only ever been on the other side of the counter during a point-of-sale transaction, you probably have many questions about what POS systems are, how they work, and whether your business needs one or not.…

Read MoreInterchange Optimization – What is It?

Visa and MasterCard, along with card issuing banks, set the cost of interchange or the base cost to process a credit card transaction. There are over 300 levels of interchange with rates ranging from as low a .05% to as high as 3.25% and everything in between. What determines the cost of interchange is based…

Read MoreVerifone VX520 End of Life

As of April 30, 2020 the Verifone VX520 is considered end of life in the credit card processing world. It’s hard to believe that this machine, once considered the tank of the industry, will be obsolete in a few short months. I remember when these machines first came out, well before the EMV mandate in…

Read MoreWhat is a Merchant Services Provider?

Your Merchant Services Provider is a vital partner that can help you operate and grow your business. They facilitate credit card processing and provide other important services for your business. Essential services offered by a merchant services provider include: What Is a Merchant? “Merchant” is a term used by payment processors to refer to their…

Read MoreIntegrated Payment Partnerships – The Key Benefits For ISVs

What Are Integrated Payments? While digital payments have been around for decades, the industry as a whole has undergone a massive transformation over the past 12 months as the shift to online payments has become the preferred method of choice when making transactions. In order to keep up with this significant shift from cash towards…

Read MoreHow to Avoid PayPal Scammers

Avoid PayPal Scammers: Digital payment systems like PayPal are more popular than ever, and scammers are following the money. Here’s what you can do to guard against them. With more than 400 million users and counting, PayPal is an attractive target for scammers. Many online scams that involve payment apps—including Cash App scams, Venmo scams…

Read MoreWhat is a Credit Card Surcharge and Can I Add One?

So you’re coming around to the idea of accepting credit cards. Great! Modern clients prefer to pay by credit card, so accepting them is an excellent way to futureproof your firm. But there’s one thing that’s holding you back—credit card processing fees. It’s a fact—any business that accepts credit card payments for their goods and…

Read More